about Kompass Kapital

We invest in people. Period.

Our values are our Kompass.

And they’re what we believe above all else.

The Power of We

Our people, our team and our relationships come before all and we are called upon to serve and support one another in order to promote ethical and honest business practices for a greater good beyond economics.

Trust

Our greatest organizational asset. We respect the speed of trust by honoring our commitments, reconciling our missteps, and seeking first to understand before being understood.

Resource Respect

We operate in a T3 mentality – our time, talent and treasure are all equally valued and deployed with priority and purpose.

Insightful

We balance the various lenses of perspective when reviewing topics and making strategic decisions. We maintain a stakeholder-centric approach in how we negotiate, structure and evaluate opportunities in order to deliver win-win results.

Evolve

The knowledge and experience we gain each day make for a better version of who we will be and what is possible in an ever-changing world.

Executive Leadership

Congratulations to our very own Sarah Schiltz, recently named 2023 Kansas City Business Journal CFO of the Year Honoree.

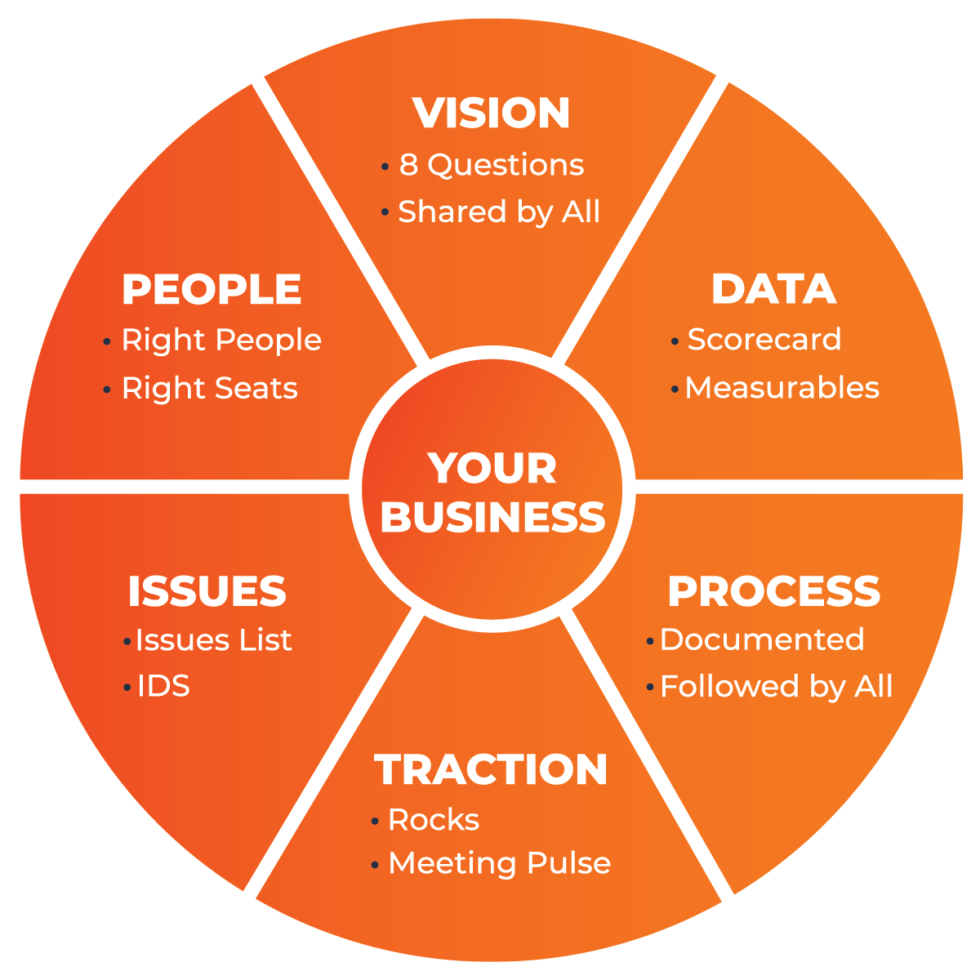

We run on EOS.

All Kompass Kapital Management companies have adopted the Entrepreneurial Operating System®, a complete set of simple concepts and practical tools that has helped thousands of entrepreneurs around the world get what they want from their businesses. Implementing EOS continues to help our leadership teams and employees get better at three things:

VISION

Get everyone in our organizations on the same page with where we’re going and how we plan to get there.

TRACTION

Instill focus, discipline, and accountability throughout the company so that everyone executes on that vision – every day.

HEALTHY

Help our leaders become a more cohesive, functional, healthy leadership team.

Meet the Team

We invest in people who create value and deliver results. Our team provides a range of business services to our operating companies that includes Corporate Affairs, Finance, Human Resources, Investments, Legal, Marketing, Operations, and Technology Services.

We've come a long way. And we're just getting started.

We’ve evolved. We’ve overcome challenges, we’ve paid attention to market shifts, diversified our investments, and we’ve seen our operating companies experience success and accelerated growth in a variety of industries. Largely because we make it a priority to hire and reward people who are extremely talented and understand our mission.

We aren’t the Kompass we were back in 2010. We’ve evolved; we’ve overcome challenges and learned from our mistakes. We’ve paid attention to market shifts and diversified our investments. We’ve seen our operating companies experience success and accelerated growth in a variety of industries. We’ve hired employees who are extremely talented and understand our mission.

It’s been a fun 10+ years. We’re looking forward to finding out what the next 10 will bring.

Gerhard Kuti founds Favorite Nurses, later becoming Favorite Healthcare Staffing, for emergency response, direct hire, travel nursing and allied health.

Touchnet, a technology driven platform for colleges and universities is established.

Kompass Kapital Real Estate is created, formerly Edelweiss Development.

Kompass Kapital Holdings formerly known as Kuti Family Investments is formed.

Barley Investments, corporate and real estate investments company and the predecessor to KKM is formed.

KKM’s Managing Partner Bradley Berger joins Barley Investments.

Build out of the passive investment portfolio. First iteration of Investment Policy and Execution.

Operating company Touchnet is sold in the organization’s first large-scale sale.

Kompass Kapital Management (KKM) is established under its current name and all investments are centralized into Kompass Kapital Holdings.

Kompass Kapital Foundation is formed, a philanthropic foundation supporting local and national charities through service and monetary donations.

Flopath – a third-party provider of shipping and freight solutions (3PL) is established, later to become Dynamic Logistix.

Formation of Kompass Kapital Global, expanding our investment profile on a global scale.

The first KKM shared business service platform with HR and Finance is offered to Flopath.

Moonshot Innovations, a managed IT service and solutions company is established to serve as a technology helpdesk for Favorite Healthcare Staffing.

Flopath rebrands as Dynamic Logistix, setting the stage for rapid growth of the company.

Krucial Staffing, an emergency response nurse staffing company, is formed.

Kompass Kapital Funding, a financial solutions partner helping growth-oriented companies improve their cash flow is formed.

KKM expands operations to Denver, establishing Kompass Kulinary, the parent company of four Denver-based restaurants Burnt Ends BBQ, Law’s Chophouse, Elevated Q, and YaYa’s Mediterranean Bistro.

Colorado River Ranch, a regenerative ranch focused on improving planet health and raising premium wagyu cattle is acquired.

Acquisition of NavMD, a health benefits analytics and solutions technology platform.

Marketing, Legal and Corporate Affairs are added to the list of services provided to operating companies within the Kompass Business Services platform.

American Wagyu Feeders, a feed lot located in Olathe, Colo. is formed.

Founders Home Service Group, a company that invests in and acquires home service companies focused on plumbing, HVAC and electrical services.

Kinikin Craft Butchers, a custom butcher and processing shop in Montrose, Colo. is acquired.

Kompass Kapital Plaza wins the Kansas City Business Journals Capstone Award for office space, significantly impacting environmental and human health by addressing carbon, energy, water, waste, transportation, materials and indoor environmental quality.

Moonshot Solutions, staffing and solutions is established.

Operating companies Moonshot Innovations and Moonshot Solutions merge to offer full-scale managed IT services and staffing solutions, keeping the name Moonshot Solutions.

Kompass Kapital acquires controlling stake in U.K.-based broadband provider LightSpeed, committing new capital to develop and expand the company's high speed fibre network and enhance their ISP platform.

KEYS TO OUR SUCCESS

Kompass Kapital has been a great partner, especially in giving support & insight when needed but also in allowing our leadership team to maintain the culture we have of empowerment to our people, which is a key reason for our growth. We are servant leaders at both Kompass Kapital and Dynamic Logistix, and it truly has helped our success unfold.

Jason Yeager

Managing Partner, DYNAMIC LOGISTIX